Earned Income Tax Credit Resources Available

MCAH has created a toolkit for use by local agencies to promote California’s tax credits including the California Earned Income Tax Credit (CalEITC), the Young Child Tax Credit (YCTC), the Federal Earned Income Tax Credit and the Federal Child Tax Credit. These tax credits are available for families earning under $30,000 per year, including those without a Social Security Number but who may have an Individual Taxpayer Identification Number (ITIN).

We’ve created these resources so that those working directly with the targeted population are equipped with the information they need to inform their participants about these important tax credits.

If you have low income and work, you may be able to apply for state or federal tax credits. These tax credits can increase your tax refund by hundreds or thousands of dollars!

|

|

|

California residents who file taxes using an ITIN and have taxable income less than $30k a year may be eligible for California tax credits. That’s money back in your pocket. An Individual Taxpayer Identification Number (ITIN) is provided by the IRS to people who don’t have a Social Security Number in order to file their state or federal taxes. #CalEITC #ITIN

|

|

|

No social security number? No problem for California tax credits.

Californians, including undocumented Californians, who use an Individual Taxpayer Identification Number to file their taxes, can now qualify for state tax credits including the Cal Earned Income Tax Credit and the Young Child Tax Credit. #CalEITC #YCTC

|

|

|

|

Si tiene bajos ingresos y trabaja, puede ser elegible para aplicar a los créditos tributarios estatales y federales. ¡Estos créditos tributarios pueden incrementar su reembolso de impuestos por los cientos o miles de dolares!

|

|

|

Los californianos residentes que declaren sus impuestos utilizando un ITIN y tengan un ingreso tributable menor que $30,000 al año puede ser elegible para los créditos tributarios de California. Eso es dinero de regreso a su bolsillo. Un Número de Identificación Tributaria del Contribuyente (ITIN) es provisto por el IRS a las personas que no tienen un Número de Seguro Social para poder declarar impuestos federales y estatales. #CalEITC #ITIN

|

|

|

¿No tiene número del Seguro Social? No hay problema para los créditos tributarios de California.

Los californianos, incluyendo los indocumentados, que utilizan un ITIN para declarar sus impuestos, pueden calificar para créditos tributarios estatales en el Crédito Tributario de Ingresos Ganados de California y el Crédito Tributario de Impuestos por Hijo Menor.#CalEITC #YCTC

|

|

|

|

|

|

|

|

|

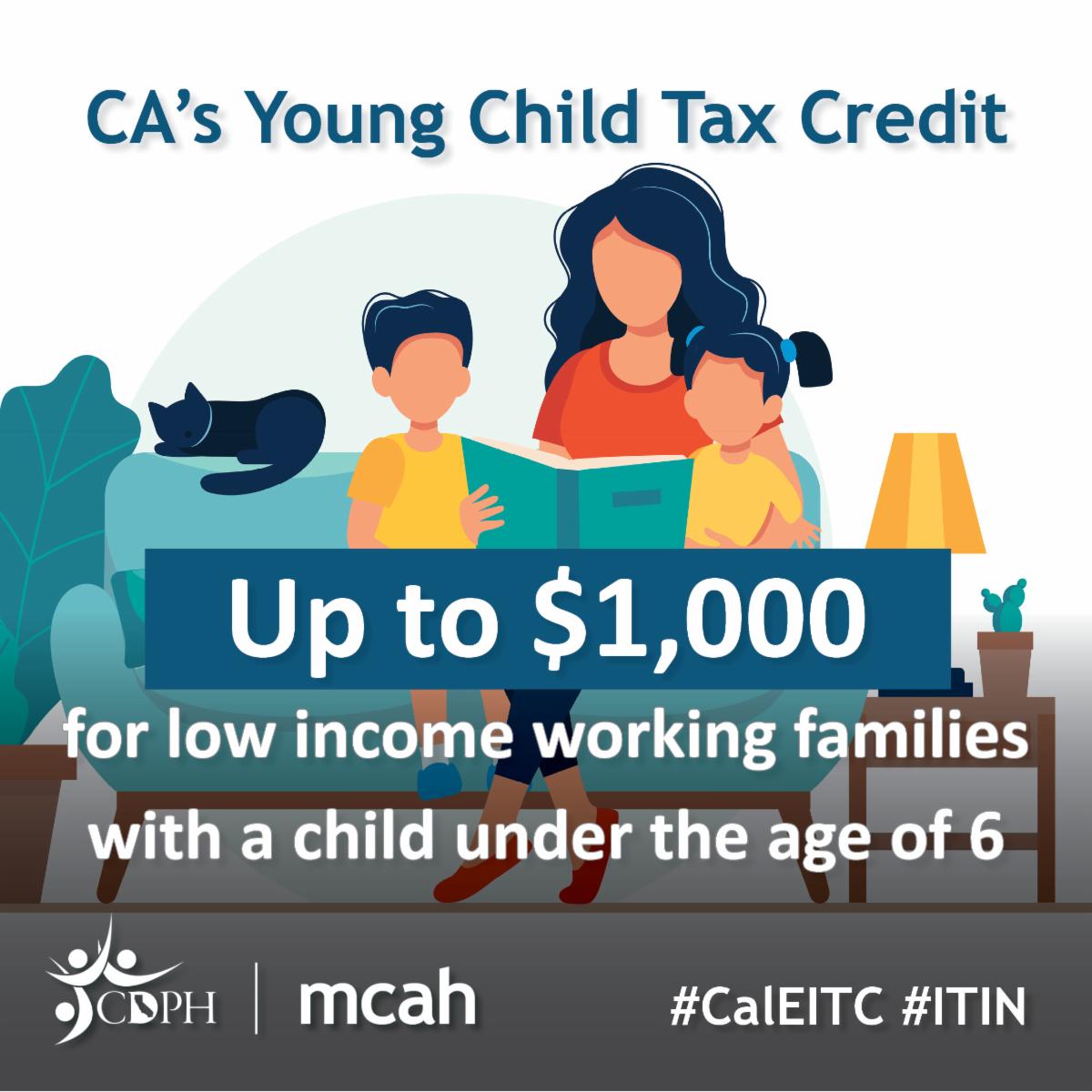

If you qualify for #CalEITC and have a child under the age of six you might also qualify for the Young Child Tax Credit, which can provide you with up to $1,000.

|

|

|

Si califica para #CalEITC y tiene un hijo menor de seis años pudiera calificar para el Crédito Tributario de Impuestos por Hijo Menor (YCTC), el cual puede proveerle hasta $1,000.

|

|

|

|

|

|

|

|

Need help estimating how much $ you can get back from the state tax credits? Use @CalEITC4me calculator to find out how much you can receive from #CalEITC and #YCTC.

|

|

|

¿Necesita ayuda para calcular cuánto dinero va a recibir de regreso con estos créditos tributarios estatales? Utilice la calculadora @CalEITC4me para poder saber cuánto va a recibir de #CalEITC y #YCTC

|

|

|

Showing 1 reaction

Sign in with

Facebook